Strong development of AUCTUS in Italy

Dear friends and business associates of AUCTUS,

At the beginning of 2022, we opened our new office in Milan at Via Camperio 9 with the aim of strengthening our commitment and presence on the Italian market. We firmly believe that Italy offers significant investment opportunities and we are therefore determined to become one of the leading private equity funds in the country. We are pleased to take this opportunity in our newsletter to better introduce ourselves as players in the Italian market and to share our vision and strategy in the hope that this can lead to successful collaborations and partnerships.

About AUCTUS

AUCTUS Capital Partners is a private equity fund that was founded in 2001 by entrepreneurs in Munich and has been successfully investing in medium-sized companies in the European market for a long time. Our main strategy is based on the buy-and-build concept: We acquire fast-growing medium-sized companies and use them to build large international groups of companies that become market leaders in their respective sectors. Throughout our history, we have helped dozens of companies grow up to 30 times their original size.

What sets us apart from others is our entrepreneurial spirit: More than 50% of our fund’s capital comes from employees in our investment team.

With over 400 majority transactions in the last 20 years, we are one of the most active funds in Europe, manage capital of around EUR 800 million and have around 45 platform companies in various European countries in our portfolio. We have received numerous awards as the best European fund.

THE HISTORY OF AUCTUS IN ITALY

The history of AUCTUS in Italy dates back to 2007 with the acquisition of Acomon in Ravenna. Since then, we have completed 29 transactions in Italy, including 7 platforms and 21 add-ons for our growing European business groups. We currently have 5 active platform companies in Italy and we plan to close at least 2 more primary transactions by the end of 2023. We are also evaluating new sectors, including medical facilities, construction, IT services and consulting, digital agencies, consulting firms, restaurant chains, etc., to find excellent platforms to implement our buy-and-build strategies.

OUR TEAM IN ITALY

Our commitment to the Italian market is steadily increasing. Since September 2022, our Italian team has grown from 2 to 9 employees and we will continue to expand by seeing and exploiting the opportunities and enormous potential of the market.

OUR PROSPECTS IN ITALY

Our investment criteria and industry experience

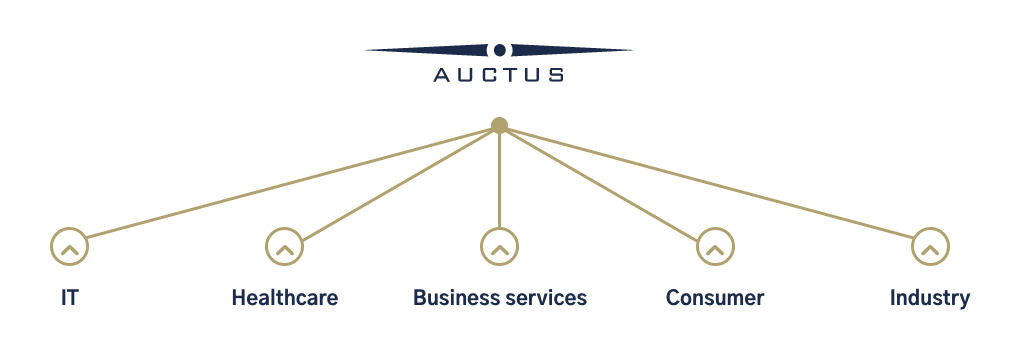

Since 2001, we have invested in around 400 companies in 5 main sectors (IT, healthcare, business services, consumer goods and industrials). Our success is based on the extensive expertise we have gained in these sectors over the past 20 years.

In the past, we have focused our interest on these sectors and concluded a large number of transactions. Some examples are listed below:

In the five market segments mentioned above, we are constantly on the lookout for potential future market leaders with the following criteria:

- Turnover between € 10 million and € 150 million

- EBIT over 2 million euros

- Strong growth and market consolidation potential

- Outstanding market positioning with a strong competitive advantage

In addition, we also look for smaller add-on companies in the markets in which our portfolio companies operate, as well as companies in a turnaround or liquidation situation.

We hope that this newsletter will help you to get to know us better and illustrate our goals in the Italian market. We look forward to working with you on our journey to become one of the leading funds in the Italian market and to turn Italian pioneers into international market leaders.

About Auctus

With over 400 investments in the last 23 years, AUCTUS is the most active investment company for European SMEs. Our investments focus on majority shareholdings in companies with annual sales of between EUR 10 million and EUR 150 million.

AUCTUS stands for sustainable organic growth, but also inorganic growth through acquisitions. We achieve this in a trusting partnership together with the management of our companies. We specialize in building successful medium-sized groups of companies - we make market leaders. The more than 35 experienced AUCTUS investment experts currently manage 50 platform investments from various sectors of the economy. The platform holdings, with a total of over 200 individual companies, generate annual sales of € 3 billion. Sales and earnings have been growing at >10% per year for years.

Our successful work is regularly rewarded with prestigious awards and top international rankings.