Former investment

Advanced Inflight Alliance

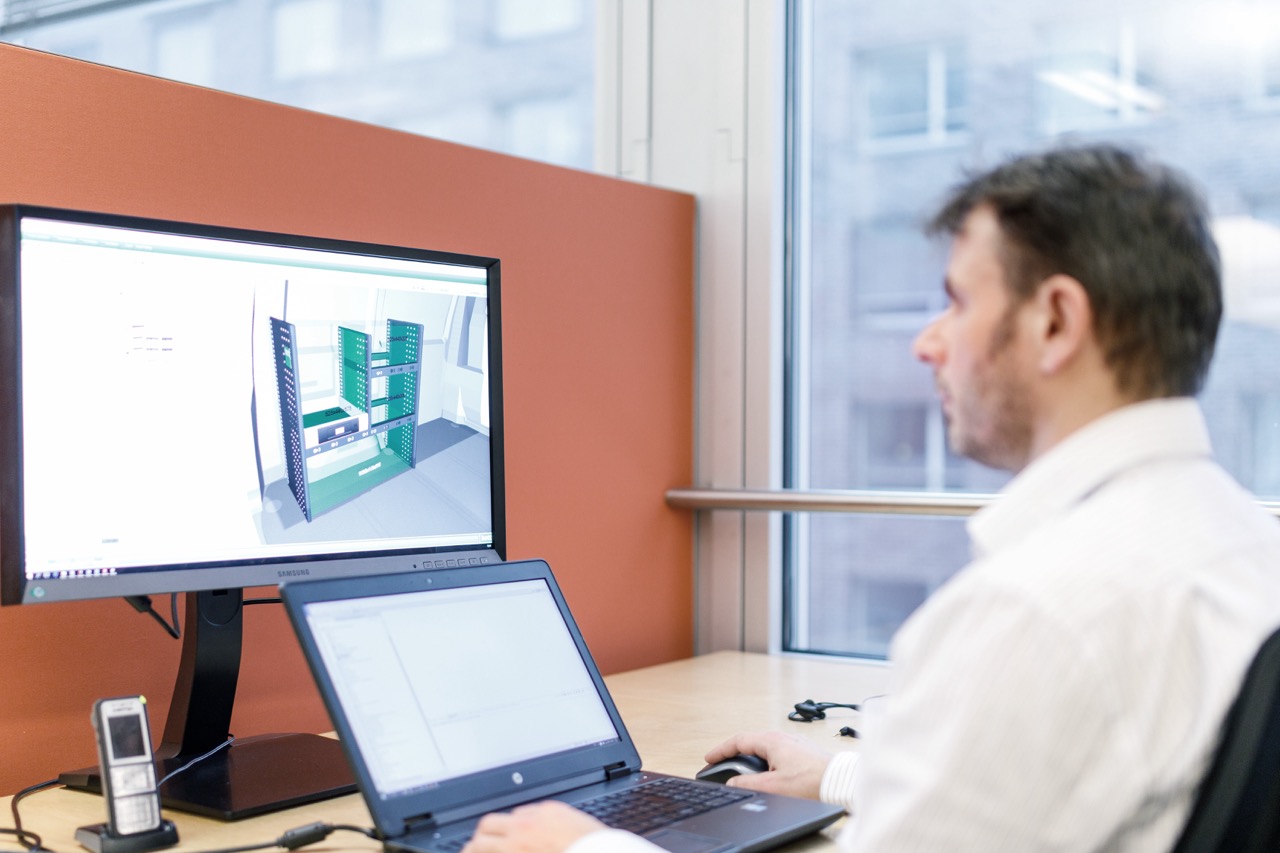

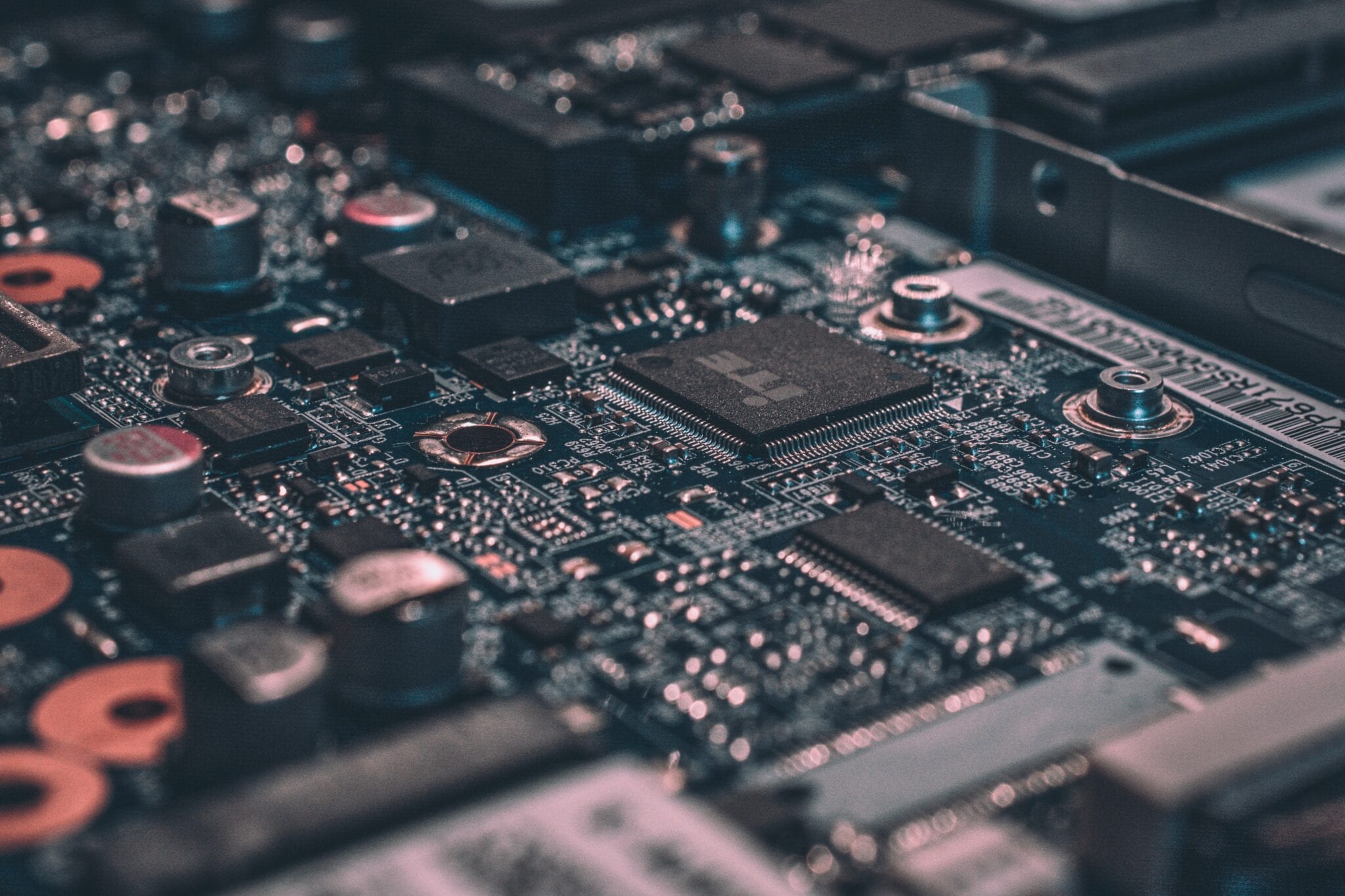

business model: The Advanced Inflight Alliance (AIA) is the market-leading provider of in-flight entertainment for passenger aircraft. With over 400 employees, the international company supplies all major airlines worldwide and enables them to offer their passengers the best entertainment with films, music, games and other software applications. AIA’s range of services includes the licensing of music and films, digital archiving and management, individualized processing and encryption as well as the development of games and other applications.

Investment consideration: AUCTUS identified the listed AIA as a “hidden champion” with a low market value at the time, which resulted primarily from the limited market liquidity of the German Prime Standard. With a market share of over 50%, Advanced Inflight Alliance AG had already achieved global market leadership in an attractive and growing market environment. In addition, the steady expansion of air traffic and the ongoing modernization of aircraft fleets mean that demand for high-quality in-flight entertainment is expected to continue to grow in the future. In addition to expansion through supplementary acquisitions, there was also considerable growth potential in the previously neglected integration of previously acquired companies.

Increase in value: Supported by the appointment of an operational COO, a company-wide optimization programme led to a significant increase in profitability. Furthermore, the previously uncoordinated and decentralized sales activities were integrated into a central sales organization. In addition, by acquiring the Asian market leader and the leading independent film marketer, AUCTUS was able to compensate for the lack of representation in the rapidly growing Asian market and expand its service portfolio to include content distribution. The necessary financing was also structured and negotiated by AUCTUS.

Exit: In August 2011, AUCTUS succeeded in selling its shares in AIA to a consortium of investors and the management team.